Splash out! How changing consumer behaviour is challenging the retail industry

It’s a fact: consumer behaviour is changing. How do you do your shopping? Do you research online before purchasing in-store? Do you order online, then collect in-store? Do you browse in-store but then order online and get it delivered to your house? Do you window shop and then order online? Or do you prefer the more traditional route of browsing and buying in-store?

The modern digital world allows for so many different options when it comes to doing your shopping. Whether it’s your food shopping, clothes and shoes, entertainment or electronics, keeping up with all the latest trends, customer behaviours, and technological advances is highly challenging for retail brands.

Technological revolutions and shifts in consumer behaviour aren’t the only factors that have drastically changed the retail industry in the past few years. The COVID-19 pandemic in 2020-21 also had a seismic impact on the sector, skyrocketing online sales and giving consumers an even broader range of shopping options to choose from. Customer intelligence and new data privacy regulations are also having a significant impact on the industry, with the need for data-centric solutions becoming key for retail brands who want to stand out from the competition in a highly competitive landscape.

In this article, we’ll be taking a closer look at how the retail industry is coping with these challenges. Read on to better understand the challenges that are shaping the retail industry in today’s fast-paced digital world.

Curious to find out more about the solutions and innovations that they’re implementing to thrive? Have a read of this article that will tell you how combining first-party and zero-party data collection with interactive marketing is the way forward in the retail industry.

Embracing omnichannel marketing

The future is neither e-commerce nor retail. It’s just commerce. So the question is, “how do you symbiotically integrate both channels”?

This quote perfectly encapsulates the current conundrum facing a lot of retailers. One thing is clear, consumers want to connect with brands across multiple channels, and they expect consistency across these from their favourite brands. Omnichannel commerce therefore needs to become the new normal as brands have to stay on top of an ever-changing marketing landscape.

With all the recent shifts and developments in technology and the growth of mobile, retail brands find themselves in an environment where they can no longer think about customer experience in silos and on separate channels. In their everyday lives, consumers are constantly switching between channels and devices, making online and in-store purchases, throughout their customer journey. This means that brands need to be on the right channels and have the right processes and systems in place to ensure a smooth and consistent experience for their audience.

The huge changes to our shopping habits brought about by the pandemic are here to stay. And even though consumers are now returning in-store as the fear of crowds and sanitary measures lessen, they’re now expecting retailers to have a consistent and seamless buying process that covers both their online and offline needs and expectations. Brands must level up their omnichannel strategy to deliver this experience to their audience.

The line between online retail and offline retail is increasingly blurred, meaning that shoppers have much more flexibility in how they choose to shop. Take the example of French optician Grandvision, who launched an interactive campaign that suggested the perfect model of glasses for their customers, based on a personality test format, just, as their staff would do in-store, before purchasing.

Furthermore, retailers are increasingly reporting that sales from their physical stores and e-commerce platforms are almost equal, closing the gap between the 2 types of shopping.

Whilst this is great news for consumers, it does mean that from a retail brand perspective, the buyer journey is more complex than ever before, as it can start and end on any channel. The traditional retail rule book has been well and truly shredded and thrown out the window! 49% of brands report that breaking down the silos between digital and physical stores is one of their biggest challenges, and 47% of brands say unifying in-store and online data is very difficult as they don’t have the right systems and processes in place.

From a marketing perspective, in order to ensure this smooth omnichannel approach that is needed in retail, brands need to improve their first- and zero-party data collection strategy both in-store and online. This will then enable them to establish cross-channel communication and build comprehensive customer profiles. Once they have these, brands will be able to share product launches, special offers, contests, … with their audience, on all their channels and in a compliant and personalised way.

This also means that the whole of a retailer’s technology stack needs to be included in their omnichannel strategy: from the logistics to the production, the delivery and the marketing. This approach will give an added sense of security to the customer’s journey, as they’ll feel supported and in good hands throughout all the stages of their purchase and beyond. Whether they’re looking for delivery and pick-up options, or need help with a refund or an order cancellation. The key to managing an omnichannel marketing strategy is being adaptable and flexible. By building a meaningful relationship with their customers, based on trust and shared values, retailers will be providing them unique experiences that only omnichannel commerce can offer.

What does the ideal omnichannel solution look like? Imagine a fully connected physical and digital shopping process where consumers can choose how they want to shop: they can buy online, from any of their devices, then pick up in-store. Or they can browse in-store, make their purchase in-store and then receive their package at home. Whichever way they want to do it, if a brand is offering that flexibility, then they’re on the right path.

The goal is to multiply potential purchase and data touchpoints. For example, buyers are more likely to add items to their basket if they don’t need to wait for delivery, so by offering immediate in-store pick-up, you’ve got this covered. And then once the customer is in-store, they can be incentivised to buy other items in-store. An informative experience with guidance or returns in-store are also ideal touchpoints.

In a recent study, Google looked at 145 businesses in Northern Europe and how they’re dealing with omnichannel commerce. Here are the results:

From a brand point of view:

- Bever (NL) came top with a score of 68% – especially strong for in-store technology and omnichannel customer service

- Magasin Kiabi (FR) and Schuh (UK) completed the top 3 podium

And for the markets leaderboard:

- UK ➡️ the best at flexible fulfilment options

- France ➡️ strong for in-store elements (digital kiosks, eReceipts, etc.)

- Scandinavia ➡️ top for customer service and product availability indicators

- Germany ➡️ poor at in-store technology but strong for removing friction and movement between channels

- Netherlands ➡️ best in cross-promotion, less good at providing information about physical stores

In the omnichannel circle, data is the fuel that connects your touch points with the customer. It allows them to see the progress of their order, when they can expect it, and if there have been changes. All those things require that we utilise our data in a smart and ethical way.

Curious to find out more about how retailers are executing an omnichannel strategy? Make sure you check out our success story with Decathlon, Europe’s leading sports goods retailer.

Customers are more demanding than ever

The age of hyper-consumerism and ‘always more’ that we’re living in means that consumers are expecting more and more from the brands they love. They want targeted, relevant and personalised messages, with a dose of convenience and value thrown in for good measure. This means that retailers need to stand out and capture their attention.

There was a certain grace period during the COVID-19 pandemic where consumers understood the difficult circumstances everyone was working in so they were willing to wait a bit longer for deliveries and understood any hiccups in the buying process. But that period is over now and consumers expect retailers to be present, to perform and to be responsive across all the touchpoints they have with them.

Brands are increasingly going to be challenged by higher customer expectations, with more pressure being put on them to perform and deliver in a timely manner. According to Mapp’s “Retail of the Future” report, data also suggests that consumers today expect in-store staff to be aware of their online purchasing history, highlighting the need for retailers to have a unified view of their customer profiles in order for actors throughout their processes to have access to this information. Unified data means richer insights that can save time and resources to focus on more productive tasks.

For example, a staff member’s time is better spent introducing the store’s loyalty program to a customer and signing them up with only a few clicks, rather than trudging through several databases trying to find the customer’s history.

When the going gets tough

The consequence of consumers being more demanding than ever is that competition amongst retailers is also higher than ever. Gone are the days when consumers would settle for less as it was the only option, in a digital world where everything is available straight away, the retail market is saturated and highly-competitive. If you’re not offering a service that consumers are looking for, they’ll have no problem finding it elsewhere.

In their “Future of commerce report” with Forrester, Shopify reported that retail businesses highlighted competition as their biggest obstacle to growth and that their biggest source of competition comes from digitally native brands that have moved into physical stores. They’re not held back by legacy and out-dated technology, processes and infrastructure so they’re much more agile and adaptable. A clear advantage compared to brick and mortar stores moving into the online sphere. And the most striking example of this comes from the retailer that made online shopping mainstream, Amazon. They’ve announced that they’re launching retail spaces that will sell clothing, household goods and electronics.

Due to the increased competition between retail brands, they’re having to create unique buying experiences for their customers, in order to stand out from the crowd. Here too, digitally native stores that are making the transition to physical stores also have a competitive edge as they’ve already been building these engaging customer experiences ever since they launched. So they’ll not only be unlocking a large and growing segment of customers who want to browse and purchase in-store, they’ll also be reducing their customer acquisition costs.

Retail brands that are able to embrace the technology needed to bridge the digital/physical store gap, such as efficient and engaging first- and zero-party data collection strategies, will have a huge competitive advantage and will be in a strong position to win and retain more customers.

Another way of standing out from the competition is by making the most of the fact that consumers are starting to put their money behind their beliefs and are more willing to interact with brands who resonate with them on a geographical, company values and sustainability level. In their study, Forrester and Shopify found that:

- Consumers are 4 times more likely to buy from a brand with strong values

- 47% of consumers say a local presence is a significant factor in their choice of brands

- 77% of consumers are concerned about the environmental impact of what they’re buying and are willing to spend more and wait longer if it’s for the right brand

- 40% of consumers intend to pay with cryptocurrencies in the next year

The end of third-party cookies

Businesses that not only own their customers’ data and know who they are, but are speaking to them and listening to them, will have a definite advantage going forward.

Third-party cookies are on their way out, they’ll no longer be supported on most browsers by the end of 2024 and businesses worldwide who have always relied on them to get insights about their audience and to push their advertising need to find new solutions. Combine this with the fact that an increasing number of privacy laws are limiting marketers’ ability to target their ads, the next couple of years are going to be crucial for retailers to prepare their marketing and data strategies to be ready for the cookieless world. However, recent reports suggest that only 28% of retail companies are ready and have a strategy in place for the cookieless world.

This will undoubtedly be a monumental shift in the digital landscape but third-party cookies have truly come to the end of their shelf-life. In a retail environment where omnichannel commerce is king, they offer a fragmented customer experience that just isn’t good enough anymore. In the next couple of years, retailers need to take stock and look at where they stand compared to where they want to be, they need to optimise their data collection and marketing strategies to be ready to switch to more digital and customer-friendly solutions to thrive in the cookieless world.

Retail brands need new and innovative ways of interacting with their customers to provide them with incentives for sharing data, and the relationship will work best if it’s a value exchange. The best way of achieving this is with first- and zero-party data as consumers are more likely to share their personal information with businesses that they trust and like, and who align with their beliefs and values. By collecting these types of data from their audience, retailers can strategically create shopping experiences that are an extension of the brand’s digital presence and community.

An increasing number of retailers are therefore embracing digital marketing, as it sends their consumers straight to e-commerce platforms and allows them to collect insights and actionable data. Consumers are using a mix of channels and devices in all aspects of their day-to-day life, and shopping is no exception. They expect retailers to be there to respond to their needs in real-time. On the retailers’ side this requires a better understanding of their customers as they are expected to deliver relevant, timely and personalised marketing messages based on the data they collect.

Post-pandemic changes in consumer behaviour

The COVID-19 pandemic shut down a vast majority of the retail industry when it hit in March 2020 as stores, production facilities and supply chain processes across the globe were shut down. Life has since pretty much returned to normal, with all shops now being open again, but the pandemic is still having lasting effects. With lockdown disruptions still being felt on the supply chain and fundamental changes to consumer habits, 2021 did finally see growth for e-commerce, with 78% of UK businesses seeing an increase in their e-commerce sales. But there are many challenges to come that are linked to the pandemic.

Less than a third of the UK retail businesses surveyed by Mapp can identify more than 21% of their users. This is due to their data being fragmented and in silos, with no software to unify it. In an environment where knowing more about your audience is vital, this is a disaster.

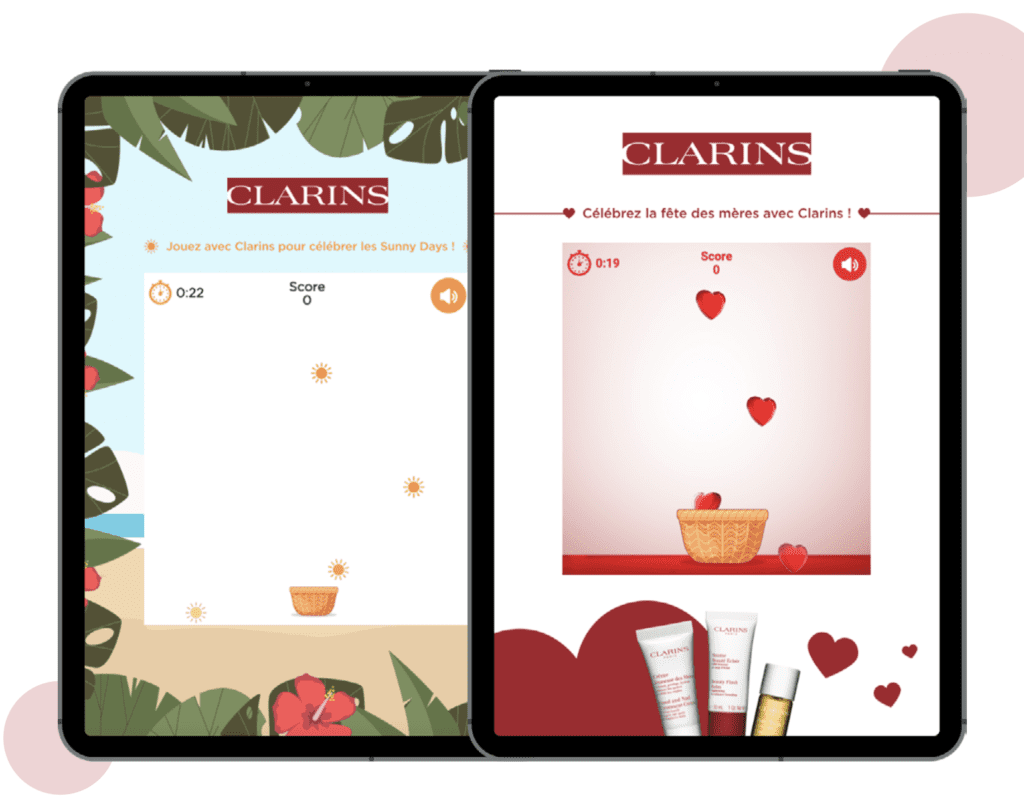

Many are expecting the future to be phygital. This new term, coined in the past years, is defined by Forbes as “the combination of physical and digital for enhanced customer experiences”. The perfect example of a brand using this new hybrid marketing strategy is Clarins, the French skincare and make-up company, who have been using interactive marketing formats to get closer to their audience.

With a target audience of an average of 45-years old, who aren’t necessarily tech- or digital-savvy, the brand’s approach to digital commerce and marketing is multi-faceted:

- They accompany their customers in-store towards their digital platforms and make their experience more fluid.

- They build customer loyalty amongst existing customers by refining their knowledge of their customers, both in-store and online.

- They bring customers and prospects captured online in-store.

Clarins use 3 types of campaigns to engage their audience:

- E-commerce campaigns to generate more sales online, with games like a wheel of fortune or a catcher. Their Mother’s Day campaign was played by over 1,800 participants, of whom 11% made a purchase.

- In-store campaigns that are used to link the physical and digital. These have included a wheel of fortune that was accessed via a QR code in-store then played on their website. They also organise events in-store that their audience can register for via a simple form.

- Satisfaction surveys allow the brand to understand who their customers are and what their needs are. They use conditional branching to show only the questions that are most relevant to the customer in order to collect more actionable and accurate data.

Recent rises in inflation mean that consumers are increasingly cost-conscious. And while price discounts may be an interesting short-term solution for brands, they also need to be thinking and planning on a more long-term basis. One way of doing this is by using first- and zero-party data smartly to create truly personalised experience and adding more value to their interactions with their audience.

Since the pandemic, consumers are also more conscious about how they shop, 47% say that a brand’s local presence is increasingly an essential factor in their choice of who they shop with. Company values and commitment to climate change and sustainability are also important factors that today’s consumers are taking into account when deciding where to make a purchase. So transparency and values-based branding are key, with 71% of consumers preferring to shop with brands that align with their values. They expect companies to talk-the-talk and walk-the-walk, with 38% saying that environmentally friendly, local and fair production conditions are very important to them.

Once again, first- and zero-party data collection combined with engaging and interactive experiences are in this case the perfect solution for brands. By getting closer to their audience and understanding their needs and expectations, they can convey the right messaging and build meaningful relationships with them, based on trust and common values. A clear advantage in today’s hectic retail environment.

Conclusion

There’s unfortunately no hiding from it, the times ahead are going to be tough for everyone involved in the retail industry. Shortages, rocketing shipping costs and the end of third-party cookies to name but a few!

But it’s not all doom and gloom, and these obstacles and challenges should be seen as golden opportunities to differentiate and diversify. Now is the time for retail brands to stand out and compete based on their value proposition, not only on their prices. Consumers want more from the brands they love, they want to buy from brands who stand for something and who are aligned with their personal beliefs.

2 words are going to be key for brands moving forwards: flexibility and future-proofing. Both these strategies will enable them to face a future full of questions and uncertainties, and ensure that they’re delivering their promises to their customers.

The key to surviving in these uncertain and challenging times is having a good understanding of your audience: What do they want? What do they expect? What do they need? And the only way of knowing this is by having a well-organised, seamless and multi-channel first- and zero-party data collection strategy in place, where there are no silos and a meaningful and reciprocal relationship is built between brands and their audience.